what are home mortgage basis points

As you can see, the expense of a mortgage factor can differ considerably based on the financing amount, so not all points are developed equal people. The home mortgage procedure can be pretty stressful and also tough to understand sometimes, what with all the crazy terminology and also heaps of documents. The equilibrium of a car loan, different from interest or add-on charges. The distinction in between the value of a residential or commercial property and any type of financings or cases impressive. Equal Credit Possibility Act is the legislation that protects against discrimination throughout the procedure of providing credit report.

Source costs are flexible yet they aid a lender cover their basic overhead & alleviate the risk a customer might pre-pay their home mortgage prior to the overhead is covered. On adjusting home mortgages this cost usually runs somewhere in between $750 to $,1200. Additionally note that not every bank and broker costs home mortgage factors, so if you take the time to search, you may have the ability to avoid points completely while protecting the lowest home loan price possible. This operates in the specific contrary method as traditional home loan factors in that you get a greater rate, but rather than spending for it, the loan provider gives you cash to pay for your fees. Of course, your monthly mortgage payment will be higher as a result.

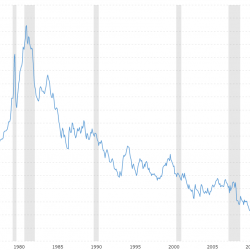

- Put another way, 100 basis factors, or bps as they're known, amounts to one percent.

- Your mortgage payment as well as home loan insurance costs will certainly enhance if your rate goes through basis point walkings.

- Because your mortgage settlement is a mix of major payment as well as your interest rate, basis point walkings will certainly enhance your regular monthly repayment.

- Though basis points might appear complicated, transforming a basis indicate a percent point is rather basic.

There are plenty of financial institutions to pick from as well as many resources– including real estate representatives, home loan brokers, and also the Web– to aid you buy the best deal for your circumstance. Origination points are generally avoidable and also negotiable so do not spend too much on them. Discount factors can save you a lot over the life of the funding, yet only if you can afford to get them without lowering your deposit below 20% and also having to get personal mortgage insurance. The APR on each loan adjusts the advertised rates of interest on the car loan to consist of all discount points, fees, source factors, and any type of other closing costs for the funding. This statistics exists to make contrast less complicated in between financings with wildly different price cut points, interest rates, and origination charges. Interest rate boosts do greater than simply Additional reading raise your settlement.

Other Things To Find Out About Mortgage Factors

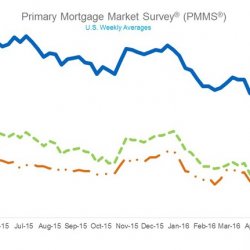

A home mortgage in which the lending institution fees below-market passion in exchange for discount rate factors. Deal benefits and drawbacks are established by our editorial group, based on independent study. The banks, loan providers, as well as bank card firms are exempt for any kind of content uploaded on this website and also do not support or assure any http://conneryemp948.fotosdefrases.com/how-does-a-reverse-mortgage-work-in-canada type of reviews. At 90% LTV, the average price got 5 basis factors, finishing the week at 2.55%, and, at 80% LTV, the ordinary rate boosted by 9 basis indicate 2.41%.

Leading 11 Financial Brand-new Years Resolutions And Also Just How To Satisfy Them

When people contrast fund costs, they gauge the difference in basis factors. A fund with costs of 0.45% what happens if i stop paying my wyndham timeshare? is stated to be 5 basis factors more pricey than one with a 0.40% proportion. Cost ratios of investment funds are often priced quote in basis factors.

Mortgage Points Vs Source Charges

At 95% LTV, the typical price fell 4 basis points, going from 3.12% to 3.08%. If you purchase factors you wish to stay in your home for a very long time without re-financing so the points pay for themselves. Paying factors is a well-known organization practice in the location where the finance was made.

Must the present mortgage price be expensive for you to get approved for the home mortgage you desire, you can "get" a lower rate by including discount rate factors, which lower your contractual home mortgage price. In normal markets and economies, paying one discount rate factor commonly will lower your begin rate, if your home loan is an ARM, or the complete regard to your home loan, if has a set price, by 25 basis points. Basis points are the unit utilized to measure rates of interest on loans, bonds and also other monetary items.

The cash generated from the greater rate of interest will cover those costs. An upfront cost billed by the lender, different from passion however made to enhance the total yield to the lending institution. Usually revealed as a percentage, as well as computed based on the finance quantity. A rate of interest that is lowered during the initial period of the funding

Call us initially or call us last, yet you can not afford to not call Basis Factor Home mortgage whereService, Integrity, andExperienceare not simply words, however a way of life. I cant find where these laws are listed and intend to be aure that this isn't just the financial institution favoring us to have a greater price for higher rate of interest for their longterm advantage. I really need to think about what works for me and also my family.

Ingen kommentarer endnu