4 times a reverse home loan is a good idea or perhaps terrific

If your built up interest and principal reach the worth of your home, you won't obtain rejected due to a forced sale, neither have financial debt continue gathering. The unfavorable equity protections legislated in 2012 restrict both of those circumstances. And also if the house is sold for much less than the quantity of the principal as well as interest owed, the financial institution will be left holding the bag. The quantity you can borrow is a function of your age as well as the value of your residence.

- If you had a charge card with a restriction of $10,000 as well as the loan provider increased your limit to $20,000, you would have more money offered to spend, but they really did not offer you $10,000.

- The $64 inquiry is can you manage the residence, and can you get approved for a car loan to re-finance the reverse home loan?

- A couple of years in a residence to stay clear of a home loan equilibrium or obtain some cash may not be the appropriate decision as the costs will certainly consume right into your equity initially quite considerably.

- So currently consumers seeking a refinance when the financing genuinely benefits the consumer, are being given the opportunity to benefit from the useful terms readily available.

Right here are reasons that you should not get a reverse mortgage. Choose the support of an excellent estate lawyer, it's not as costly as several points and also it will conserve you over time. Unlike a Home Equity Line of Credit or a bank card, the finance will not continue to be open with a zero balance. There is never ever a prepayment fine so you might make payments in any kind of quantity at any moment scot-free. So, at the end of the year, your line would be approximately $103,500 and also not $100,000.

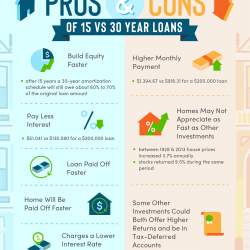

An additional feasible disadvantage would be regrets by taking a reverse home loan prematurely in your retirement years. As you get older your needs may change and ultimately a scale down might be of passion. Make certain that you weigh all advantages and disadvantages and seek advice from your trusted expert on whether a reverse home loan is best for your conditions.

Patricia French is a Monetary Counsellor and Specialist Human Ecologist specializing in intending with customers under the age of 50. She is an experienced facilitator, pre-retirement instructor, and University trainer with the Department of Human Being Ecology at the College of Alberta teaching in the area of household financing. She is driven to supply customers, individuals, and also students with essential knowledge, skills, as well as techniques to browse the frequently potholed economic roadway https://zenwriting.net/cillenb3o0/a-fixed-rate-car-loan-has-one-interest-rate-over-the-life-of-the-home-mortgage in advance. Payments from a reverse mortgage are tax-free income, so income-tested advantages such as OAS as well as GIS will certainly not be impacted. And there's another potential reason we'll see more passion backwards home mortgages.

Refinance Your Existing Loan

There is a risk/chance that the equity is decreased substantially as well. As you obtain, if home prices lower this could be a dual whammy. If your heirs fit financially as well as do not want to acquire the house this is not a down side or a bad thing.

Reasons Why A Reverse Mortgage Could Not Benefit You

Depending upon the service provider, funds can be gotten as a lump sum, regular settlements or a mix of lump sum and normal payments. The liberty to get rid of month-to-month payments can be a benefit for extended budget plans. A reverse home loan gives you accessibility to funds without sending you a prompt bill. Our professionals have actually been aiding you grasp your money for over 4 decades. We constantly aim to offer customers with the specialist guidance and tools needed to be successful throughout life's financial trip. Bankrate's editorial team writes in behalf of YOU– the visitor.

However we prompt consumers to still get propositions from more than the one lending institution whose leaflet they got in the mail and contrast. I'm sorry you feel that way however without recognizing it, you only resemble what we have been saying. Get all the info as it refers to your conditions, discuss with your relied on monetary advisor and decide that is right for you. If your best objective is timeshare buyout to move to one more location to either be closer to family or to downsize to a smaller residence, a Reverse Home loan may not be the very best option for you as the Reverse Home mortgage balance will certainly increase over time. If you obtain the reverse home loan, the assessed value will certainly be developed by an independent appraisal performed by a qualified FHA accepted evaluator. If you presently have an existing home mortgage balance on your home this info will certainly be needed too.

Yet not everyone has a senior's best interest in mind, as well as lots of scammers use this kind of finance to trick older Americans out of their hard-earned money as well as equity and, in many cases, their homes. Essentially, reverse mortgages were rearranging wide range from the inadequate to the predominately center class. Starting in October 2017, new guidelines require possible consumers to make a lot higher ahead of time repayments and considerably decreased the amount that can be borrowed. As soon as you have chosen a lender, the residential property is assessed to identify its market value. Borrowers can obtain 50% to 66% of the worth of their equity. depending what happens to a timeshare when you die upon their age and also rate of interest, which is usually regarding 5%.

Ingen kommentarer endnu