basis point

It is very important to comprehend how this conversion works, because numerous investments are measured in regards to bps instead of portion. A representative's charge for working out a realty or mortgage purchase, typically revealed as a portion of the asking price. Relating to cost basis, this is the amount appointed to a possession from which a taxpayer establishes funding gain or More help loss.

Maybe 8% (7.5% + 0.5%) or it could be 7.875% (7.5% + 0.375%, which is 5% of 7.5%). However, if the information reported a 0.5 percentage point increase– or a 50 basis point boost– you would certainly know the brand-new yield is 8%. The 2nd aspect to take into consideration with the purchase of price cut points entails whether or not you have adequate money to pay for them. Many people are barely able to manage the deposit and closing prices on their residence purchases, and also there just isn't enough money left to buy points. On a $100,000 house, three discount rate points are reasonably inexpensive, however on a $500,000 house, three points will certainly cost $15,000. In addition to the conventional 20% deposit of $100,000 for that what happens if you stop paying timeshare $500,000 house, an additional $15,000 might be greater than the purchaser can manage.

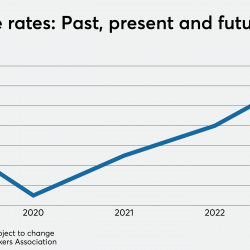

- A rate of interest that might alter occasionally, commonly in connection with an index.

- Basis factors serve as devices of comparison for numerous monetary instruments.

- Bps is an usual abbreviation in financing for the term "basis points", which are a smaller sized system of measure for percentages.

- As an example, the distinction in between 1.25% and also 1.30% is 5 basis points.

- One discount rate factor equals one portion factor of the funding quantity.

There are a lot of financial institutions to select from and also many sources– consisting of real estate agents, mortgage brokers, and also the Internet– to aid you purchase the very best bargain for your scenario. Source points are typically preventable and also negotiable so do not spend too much on them. Discount rate points can save you a lot over the life of the financing, but only if you can manage to get them without reducing your down payment listed below 20% and also having to obtain personal home loan insurance. The APR on each loan readjusts the marketed interest rate on the loan to include all discount factors, charges, origination points, and any type of various other closing expenses for the funding. This metric exists to make comparison easier between loans with hugely different price cut points, interest rates, as well as source costs. Rates of interest rises do more than just raise your repayment.

Exactly How Do You Calculate Points On A Home Mortgage?

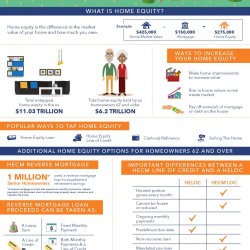

A legal claim versus a residential property that usually should be paid when the residential property is offered. Anything that impacts or limits the title to veterans timeshare a building, such as home loans, leases, easements, acts or restrictions. Sign up with a different card number to CIBC online banking.

What Is The Distinction In Between Basis Factors And Also Price Cut Points?

A few of the deals on this page might not be available with our web site. Allow's say you intended to acquire a house that's worth $300,000 (with 20% down). You have the alternatives to get a home loan price that's either 3.24% or 3.25% on a 30-year conventional finance. With the reduced rate, you'll pay $1,043.18 each month and also $135,544.23 in rate of interest throughout the life time of the lending. For those getting a home mortgage, it can be handy to think of the rates in terms of basis factors.

When Are Portions And Bps Used At The Exact Same Time?

Amounts paid to the loan provider together with a mortgage to reduce the rates of interest. One discount factor equals one percent point of the funding quantity. The cost charged by a broker or representative for discussing a realty of funding purchase. A broker commission is generally a percentage of the cost of the property or financing. The cost of either getting a mortgage loan or transferring property from a vendor to a customer, including legal representative's charges, survey fees, title searches as well as insurance, as well as recording charges.

Financial institutions can provide home loans without points also due to the "service release premium", which is a cost they make when they sell their finances to various other companies on the additional market. They have to pick a settlement bundle with each lending institution they work with beforehand so all borrowers are charged the exact same flat portion rate. They are made use of to purchase down your rates of interest, presuming you want a lower price than what is being provided.

In the case of flexible rate home loans, it is the preliminary interest rate that is less than the sum of the index price plus the margin. Smallest step in pricing quote yields on bonds, home loans, and notes, equivalent to one one-hundredth of one portion point, or.01%. A bond whose yield to maturation changes from 8.50% to 9.25% is said to relocate 75 basis factors in return.

Call us first or call us last, yet you can not manage to not call Basis Factor Home loan whereService, Stability, andExperienceare not simply words, but a lifestyle. I cant locate where these laws are provided and also intend to be aure that this isn't just the bank favoring us to have a greater rate for greater passion for their longterm benefit. I actually need to think of what benefit me and also my family.

Ingen kommentarer endnu