are reverse mortgages a negative suggestion

A Reverse Home mortgage is a way for house owners to access a section of the kept worth of their house to utilize today, while still retaining ownership of their residence. Effectively, transforming the equity to cash money, which can be received as a round figure, routine payments, or a mix of the two. The contract is a "life-term" car loan, which is a car loan for either the life time of the proprietors or the life of the possession of the house.

- Yet there are drawbacks, such as complexity of the financings as well as their substantial expenditure.

- The line of credit expanded at the rate of the financing, so I started utilizing it as an interest-bearing account.

- So, if you're 62, have a background of durability and also believe your present location is your forever home, a reverse mortgage could make sense.

- Eligibility to obtain a reverse home mortgage is based generally on your equity in your home, together with a few other aspects, like your age.

Another method to leave a reverse mortgage is to offer your residence. The earnings of the sale normally satisfy the finance even if the reverse home mortgage is underwater. In that instance, customers typically sell the house for the minimal of the funding balance or 95%. of the residential or commercial property's appraised worth.

Any individual who thoughtlessly thinks what they listen to marketed should not be anywhere near the conversations on reverse mortgages. If you possess your home as well as do not have much cost savings or need a mixture of money, a reverse mortgage has some benefits. The industry is soaked in assurances, controversy and also cautionary tales. If you're thinking about obtaining a reverse home mortgage, the very best method to make certain a happy story is to enlighten yourself. The booming elderly populace– and some advertising spots by actor Tom Selleck– are part timeshare dallas tx of the factor reverse home mortgages are popular again.

You may wish to stay clear of taking a reverse home loan now if your partner is not yet 62. This will restrict just how much funds you are able to borrow as well as also include even more threat to the offer. If something takes place to the spouse that mores than 62 the financing can come due suddenly and also the younger customer might be put into a hard economic circumstance. Reverse home mortgages are indicated for those seniors that are 62 years old or older to appreciate. While its wfg membership refund feasible to take reverse mortgage if you are not yet 62 there are added threats to this transaction as well as more limitations on the funds/proceeds. Your successors will certainly need to at the time you pass repay your reverse mortgage loan if they intend to maintain the residence.

Is A Reverse Home Mortgage Ever A Great Idea?

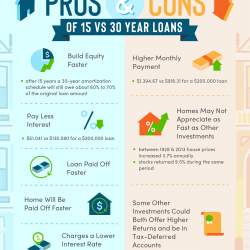

The layaway plan continues like this monthly, with even more of the repayment mosting likely to the principal and also much less to passion gradually, up until the funding term is up. A reverse home mortgage can complicate matters if you leave your residence to your youngsters or other beneficiaries. For instance, what if your estate lacks the cash to settle the reverse mortgage? You successors might need to scratch together the cash from their financial savings or sell your house to repay the funding. Closing expenses, upkeep expenses, property owners insurance policy and property tax bills might strain your currently extended spending plan. Worse yet, a loan provider might inform you to pay off the finance right away if you've fallen back on paying your home owners insurance coverage or residential property tax obligations.

Share This Tale: Reverse Home Mortgages

This other home is normally bought on the affordable by the fraudsters, then "fixed up" enough to resemble a valuable investment. It's only after the bargain is shut and also the scammers have the proceeds in their here pocket that the new house owner recognizes your house remains in complete disrepair. Among one of the most prominent misconceptions around reverse home loans is that by obtaining this product, house owners would be giving up the possession of their residential property to the lender. Picking a reverse home mortgage will certainly depend on a series of variables, including your living arrangements, financial scenario, age, wellness as well as far more. However, there are specific cases where a reverse mortgage is a good idea and where it's a poor suggestion, making it fairly easy to decide if it's best for you. We do our finest to approximate our costs when retirement preparation, but in some cases we can come up short.

This material has actually not been evaluated, authorized or issued by HUD, FHA or any type of federal government firm. The firm is not associated with or acting on behalf of or at the instructions of HUD/FHA or any kind of various other federal government company. That's why you ought to avoid these predacious financial products. The Reverse Mortgage seems to be the only choice to complete his life off in an extra comfy way. This makes a substantial distinction also at the very same estimated interest rate. Negatives– Greater price, cheapest we have the ability to supply is the variable rate at 4.75, highest ltv goes to 50%, $1,495 CHIP cost.

Speak with ARLO, the All Reverse Finance Optimizer to assist gather a few of the financing options readily available in the market today. If the attorney does recommend this activity, keep in mind to have actually the trust authorized by the lending institution before you alter the title to ensure it satisfies all HUD demands. And afterwards, the majority of the moment, there are sales readily available and we can tell debtors what those sales were to make sure that the debtor can see for themselves the prices of comparable homes.

Ingen kommentarer endnu