compare todays home mortgage and also refinance rates

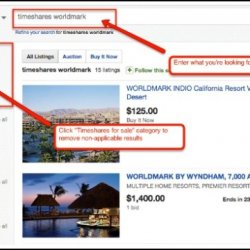

Use this tool throughout your homebuying timeshare exit attorneys process to check out the range of home loan interest rates you can expect to receive. See just how your credit history, funding kind, home price, and deposit amount can impact your rate. Knowing your options as well as what to expect helps guarantee that you obtain a home loan that is right for you. Check back often– the prices in the tool are upgraded every Wednesday and Friday. It's often worth refinancing for 1 percentage point, as this can produce significant savings on your home loan settlements and total interest payments. Just make sure your re-finance savings validate your closing prices.

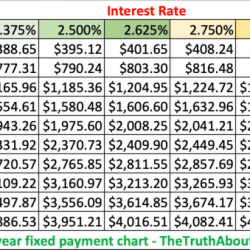

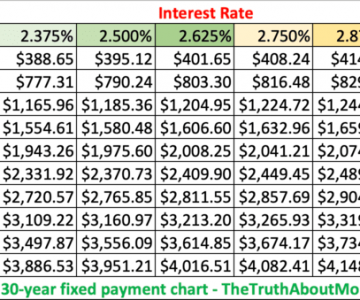

It's revealed as a percentage, and if it's taken care of, it will certainly never ever transform. Flexible home loan rates are fixed for a limited amount of time, possibly 3-10 years, and after that usually reset every year after the introductory duration. APR, or annual percentage rate, is a computation that includes both a lending's rates of interest as well as a financing's finance costs, shared as an annual expense over the life of the loan. Jumbo prices are for financing amounts exceeding $548,250 ($ 822,375 in Alaska and Hawaii). Conforming Fixed-Rate Loans – Adapting prices are for financing amounts not going beyond $548,250 ($ 822,375 in AK and also HEY).

- If you like one loan provider, yet one more loan provider offers you a better price, show the initial loan provider the reduced quote as well as ask them if they can match it.

- Normally, home loan rates of interest move separately as well as ahead of the federal funds rate, or the amount banks pay to obtain.

- So the larger your down payment as well as the greater your credit rating, typically the reduced your home loan price.

- Check out on-line loan providers, brick-and-mortar organizations http://josuequnw343.bearsfanteamshop.com/the-basics-of-basis-points as well as the financial institutions or credit unions you work with.

- Your monetary circumstance is distinct and also the product or services we examine may not be best for your situations.

These averages offer debtors a wide sight of average rates that can notify customers when comparing loan provider deals. We feature both the rate of interest and also the annual percentage rate, that includes additional lender charges, so you can obtain a better concept of the overall price of the finance. The actual rates of interest you can qualify for may be various from the ordinary rates priced estimate in our price table. See our current mortgage rates, low down payment options, as well as big mortgage loans. Unlike a fixed-rate mortgage, ARMs are impacted by market changes. However, the reverse is additionally true– when rates rise, your monthly repayments will additionally climb.

Theres More To Take Into Consideration Than Just A Great Price

These rates are not ensured as well as undergo alter. Your assured price will rely on various variables consisting of loan product, loan dimension, credit report account, building value, geographic place, occupancy and also other factors. A home loan price, additionally referred to as an interest rate, is the fee billed by your loan provider for lending you money.

Obtain The Best Home Loan To Fund Your New House

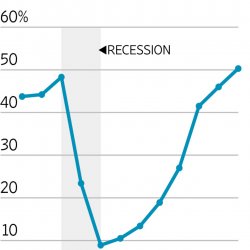

Several home wesley financial group bbb mortgage buyers don't understand there are different types of rates in today's home mortgage market. So if you have not locked a price yet, don't shed too much rest over it. There are still large amounts to be had– specifically for customers with strong credit report. Interest rates are a crucial factor in link with the funding of a residential property. Particularly where the lending amount is high, also minor changes in the rate of interest can have a big impact on total prices. Trends in rate of interest have an impact on the costs, chances and threats of your residential property funding.

A fixed-rate financing has one interest rate over the life of the mortgage, to make sure that the monthly principal-and-interest repayments remain the very same up until the lending is settled. An adjustable-rate mortgage, or ARM, has a rate of interest that can increase or down periodically. ARMs commonly begin with a low rates of interest for the first few years, yet that rate can go higher. While these programs have foundations of reduced home mortgage rates, lenders may readjust the rates higher due to the risk they really feel is fundamental in reduced- or no-down-payment financings. The more lenders you check out when shopping for home loan prices, the more probable you are to get a lower rates of interest.

Jumbo financings are also a little bit more expensive than conforming fundings. It's an excellent suggestion to secure the rate when you're accepted for a mortgage with an interest rate that you fit with. Consult with your finance officer on the timing of the price lock. Ideally, your rate lock would extend a couple of days after the expected closing day, so you'll obtain the agreed-upon rate even if the closing is delayed a couple of days. These financings have tolerant qualification requirements as well as are eye-catching to new residence purchasers. When you're ready to get serious about acquiring, the very best thing you can do to get a far better interest rate on your mortgage is look around.

No early repayment bills if 25% of the loan is paid after 6 months and also within 36 months. Home mortgage rates are forecasted to typical near 3% in 2021, according to the real estate market projection from Tendayi Kapfidze, LendingTree's chief financial expert. Generally, industry experts do not anticipate the housing market to crash in 2022. However much of the risk aspects that brought about the 2008 collision are absent in today's market. Reduced stock and also massive purchaser need need to maintain the marketplace propped up next year.

Exactly How Do I Locate The Most Effective Mortgage Rate?

Typically, 620 is the minimal credit score needed to buy a residence, with some exemptions for government-backed loans. National prices aren't the only thing that can sway your home mortgage rates– individual details like your credit report likewise can impact the cost you'll pay to borrow. Home loan rates continue to be at historically reduced levels, although they are starting to increase. That indicates numerous home owners still could save by refinancing. Due to the fact that home worths have climbed sharply, it's possible that a refinance could free you from paying for private mortgage insurance.

For much of the populace, acquiring a home implies working with amortgage lenderto obtain a home loan. It can be hard to identify just how much you can pay for as well as what you're spending for. Once you discover a price you such as, secure it in as soon as possible since prices can transform over night.

Ingen kommentarer endnu