todays home mortgage prices

Due the COVID-19 crisis, home mortgage prices dropped to extraordinary lows. Census Bureau reported that house sales raised by 43% contrasted to the previous year. By October 2020, the Washington Message reported that the ordinary 30-year fixed-rate mortgage fell to 2.81% from 2.87%.

- APR is a device used to contrast lending deals, also if they have different rates of interest, costs and price cut factors.

- Various other times, the reduction in rates of interest for every point paid might be smaller.

- Over the last few years, FHA mortgages had greater default prices than standard financings, according to analytics business CoreLogic.

- MIP for FHA loans is determined based upon the debtors loan-to-value ratio.

- Our team believe every person must have the ability to make monetary decisions with confidence.

Today, besides low deposits offered by the FHA, just government-backed home loans such as VA finances as well as USDA car loans supply 100% financing options. FHA home mortgages are an excellent option especially for newbie property buyers and debtors with restricted revenue. The standard FHA program provides a reduced 3.5% deposit as long as you have a credit rating of 580. Debtors with reduced credit rating in between 500 to 579 can likewise safeguard an FHA funding, provided they pay at the very least 10% down. FHA mortgages are understood for budget-friendly down payments as well as loosened up credit score criteria. It's a viable alternative to conventional car loans which impose stricter credit history requirements.

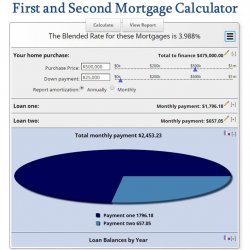

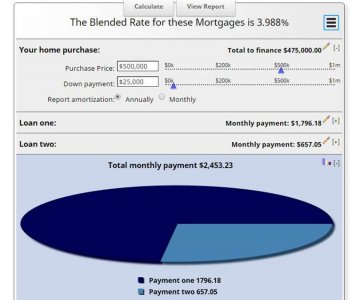

Annual Percentage Yield Apr

Don't neglect to consist of various other expenses in addition to your home mortgage, which includes any type of appropriate HOA costs, property owners' insurance, real estate tax, and residence maintenance costs. Using a home loan calculator can be practical in this circumstance to help you figure out how you can comfortably pay for a home mortgage settlement. Nonetheless, over the long-term, buying a home can be a good way to boost your total assets. And when you acquire, you can secure a set rate of interest, which implies your monthly payments are less likely to increase compared to renting.

When Is The Right Time To Obtain A Home Loan?

A rate and also term refinance can decrease your rates of interest and also reduce your month-to-month payment. A range of FHA adjustable-rate mortgages are readily available with initial fixed-rate durations of one, 3, five, 7 or 10 years. When the preliminary fixed-rate duration ends, the financing will readjust, indicating your rate and repayment can rise or fall for the rest of the finance term. For mortgage loans, omitting house equity lines of credit, it consists of the interest rate plus other fees or charges. Buying a home can be an interesting as well as brand-new procedure for many individuals. If your objective is to purchase a home with a minimal deposit as well as low-interest prices, FHA finance rates of interest could be the best fit.

Considering that loan providers figure out prices based on the threat they may take, customers who are much less creditworthy or have a lower deposit quantity may be priced quote greater rates. In other words, the reduced the Browse this site danger, the reduced the rate for the customer. Initially, your lender will identify what it believes you can manage based on your income, financial obligations, possessions, and responsibilities. Lenders will likewise consider your DTI, suggesting that the greater your DTI, the much less likely you'll have the ability to pay for a larger home loan. Lease or get is about more than just contrasting your monthly rental fee to a possible mortgage payment. The length of time you plan on staying in that location must likewise factor into the choice.

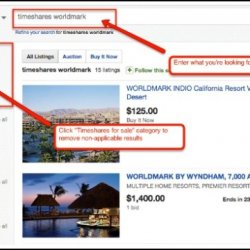

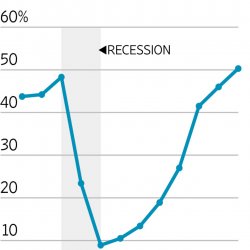

Various other conventional lenders might allow approximately 50% with compensating variables. The adhering to chart details ordinary FHA car loan prices beside typical conventional finance rates from the year 2000 to 2020. According to the Mortgage Bankers Organization, on November check here how to remove timeshare foreclosure from credit report sixth, 2020 the 30-year fixed price home loan had an ordinary cost of 2.98%. The typical FHA 203 financing was a tenth of a percent higher, at 3.28%. Historically when the economy is hot the share of standard finances boosts, and also when the economic situation goes into an economic crisis the government-backed programs gain marketshare. Unlike an interest rate, nonetheless, it consists of other fees or costs to reflect the overall expense of the car loan.

If you're eligible for these home loan products, you might qualify for reduced income and credit report paperwork requirements, in addition to lowered or forgoed appraisal needs. FHA refinance finances can be open to those with poor credit score, consisting of people with a FICO credit history as low as 500, depending upon the sort of deal. " The biggest limitation for FHA lendings is the optimum car loan quantity, which is calculated based upon median home prices," says Heck. An FHA refinance is a re-finance of an FHA financing in which you change the rates of interest and/or other terms of the car loan. FHA is short for the Federal Real Estate Administration, which is part of the U.S

Ingen kommentarer endnu