reverse home loan testimonials

Let's presume that the worth of his residential property will expand at a typical annual speed http://emilianofhzr441.theglensecret.com/do-you-know-the-8-types-of-home-mortgages of 4%, which is a conservative quote considering what we have actually experienced over the last 2 years in Canada. And also, for the sake of this example, allow's say that the interest rate on Barry's reverse mortgage rests at 6.5%. The truth is that, in the ideal economic context, reverse mortgages can be an effective economic tool. The increasing variety of seniors buying reverse mortgages is due to luring promotions including trusted stars, such as famous Canadian number skater Kurt Browning. Tom Selleck could say reverse home loans are not too great to be true. The typical reverse mortgage borrower attracted 64% of their equity under the old rules.

- The quantity you can obtain is a function of your age and the value of your house.

- Established in 1976, Bankrate has a lengthy track record helpful individuals make smart monetary choices.

- Out if that cash you need to fix your residence to fulfill their requirements.

- There are also lots of charges on these fundings, making it all even worse.

- If your health issues end up being much more substantial, resulting in you going to a long-term care center for more than a year, your lending institution may request a full loan reward.

After that as long as you adhere to your strategy, you will constantly know what you owe and what asset is readily available to pass to your heirs. I would certainly make sure that you obtain cord instructions and also cable the funds so that there are no doubt regarding the schedule of funds when you do make the reward yet that is your call. My spouse has one to me it was all prohibited back in 2008 i actually want to take them to court as well as get my residence back.

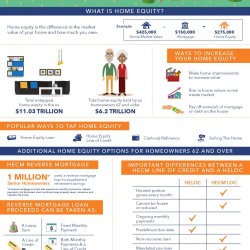

Reverse Mortgage Credit Lines

Rate of interest has a method of building up, and also it will certainly with a reverse mortgage. That's since your lending institution fees you rate of interest on your lending balance that you continue to continue year after year. You can get the money in various means, also, either in a lump sum, equivalent repayments over a fixed period of months or years, as a line of credit to be touched whenever you desire, or as a mix of these alternatives. If you were to take a line of credit with an initial draw of $70,000, the lending requires you to make no month-to-month repayments however you can make any kind of repayment in any quantity you desire at any time.

High In Advance Expenses

Some state and city government companies, along with non-profit organizations, supply these car loans. If you qualify, these programs are a far better alternative than getting another sort of reverse home mortgage. A lot of reverse home loans are Residence Equity Conversion Mortgages, which the U.S. federal government guarantees via the Federal Real Estate Management.

Various Other Insurance Coverage

Keep in mind that this is not financial advice and that only you as well as your trusted monetary consultant can make this decision … however the reverse mortgage does offer you another alternative to consider. Numerous reverse home mortgages do not have income or credit report requirements. Unlike retired life income from 401s and also Individual retirement accounts, money acquired via a reverse home mortgage is not treated as revenue by the internal revenue service as well as is, therefore, not taxable. If you're going to get a reverse mortgage, ensure you understand specifically what you're registering for, and also assess the costs entailed.

Ingen kommentarer endnu