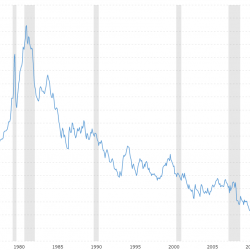

contrast present mortgage prices

Interest rate stats on brand-new contracts is a means of measuring the price development on fundings and deposits in a given duration. These stats include all monetary arrangements in which the conditions impacting the interest rates on down payments as well as borrowing are determined for the first time. The statistics additionally include renegotiations of existing loans and also relocation of finances. Modifications in drifting interest rates due to automated modifications are ruled out new arrangements. Non-financial companies' average rate of interest for new financial institution deposits was 0.02 percent. The rate of interest on accounts with repaired durations or a limited variety of cost-free withdrawals was -0.03 percent.

- You can utilize read more the car loan quantity printed on your preapproval letter as a guide for your residence searching journey.

- Acquiring a house with a home mortgage is the biggest financial purchase a lot of us will certainly enter into.

- Ultimately, when you're comparing price quotes, make certain to look at the APR, not simply the rates of interest.

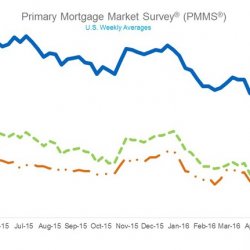

Just how frequently a variable-rate home loan modifications is based on the car loan's terms. For example, a 5/1 ARM (variable-rate mortgage) would have a set rate for the first five years of the financing, after that alter yearly afterwards. The term, or size, of your finance, likewise establishes just how much you'll pay monthly. The longer the term, the lower your month-to-month payments will usually be. Look into the mortgage rates graphes listed below to locate 30-year as well as 15-year mortgage rates for each and every of the different mortgage U.S . If you make a decision to purchase home mortgage discount rate factors at closing, your interest rate may be less than the prices revealed right here.

Various Other Loans

International financial data are also released on a quarterly basis. Get a money back mortgage offer based on your home loan quantity and also term. How much Thehouse you can afforddepends Helpful resources on a variety of aspects, including your income as well as financial debt. If you prepare to take the jump into homeownership, we can obtain you started on the appropriate course. Liz was a reporter at Expert, primarily covering personal-finance topics. To obtain your picture, usage ourFind and also Comparetool to generate an illustration for any of the mortgages shown.

Department of Farming as well as cater to buyers in designated rural areas. You're typically not called for to make a down payment, yet you will certainly need to meet earnings demands. These lendings typically require a minimum 620 credit rating as well as 3% deposit. Borrowers who take down much less than 20% needs to spend for personal home loan insurance.

Already Banking With Us?

The loan provider guarantees that the home mortgage price supplied to a debtor will continue to be readily available to that borrower for a stated time period. With a lock, the borrower does not have to worry if rates increase in between the time they submit an offer as well as when they close on the home. Home loan allow purchasers to break up their repayments over an established number of years, paying an agreed amount of passion. Mortgages are additionally legal papers that allow the home loan owner to assert the residential property if the purchaser doesn't make their repayments. It likewise shields the customer by forbidding the home loan holder from taking the residential or commercial property while routine repayments are being made.

If they https://zenwriting.net/cillenb3o0/having-a-house-likewise-has-actually-the-added-benefit-of-providing-a-more climb, then you could wind up paying more on your home loan. Conserve for a down payment.Depending on which type of home loan you get, you might need as high as 20% for a down payment. Putting down a lot more could land you a far better interest rate. A discount factor is a cost you can choose to pay at closing for a lower rate of interest on your home mortgage. One price cut factor normally sets you back 1% of your mortgage, and it minimizes your price by 0.25%.

If you choose that we do not utilize this information, you may pull out of on-line behavioral advertising. If you opt out, though, you may still obtain common advertising and marketing. We aim to provide you with information regarding services and products you might find fascinating and helpful. Relationship-based advertisements as well as online behavioral marketing help us do that. The rate of interest on a finance, revealed as a percent. In federally marked cities, conventional as well as federal government financing restrictions have actually been boosted to assist buyers.

1 Rates are subject to alter without notification at any time. Deal might change or be taken out any time without notification. Select from a wide range of mortgage alternatives that give you. affordable prices and customized loaning solutions. The security of a set rate of interest as well as the versatility to repay as much of your mortgage as you desire, when you desire. If your down payment is much less than 20% of the home value, your home loan is high-ratio as well as you need to purchase home mortgage default insurance policy.

Ingen kommentarer endnu