calhfa rates

. The FHA lending category began in the 1930s to improve residence sales. The united state government does not make the lendings, yet but instead insures them. Cardinal Financial Company, likewise known as Sebonic Financial, uses refinancing for conventional as well as government-insured car loans, consisting of FHA streamline refinances. A major component of APR https://cesarampx258.bcz.com/2022/02/11/if-i-have-a-reverse-mortgage-loan-will-my-youngsters-or-successors-have-the-ability-to-keep-my-residence-after-i-die/ is home mortgage insurance coverage– a plan that secures the lending institution from shedding money if you default on the mortgage. APR is a device used to compare loan offers, also if they have different rate of interest, fees as well as discount rate points.

- Are charges you pay the loan provider upfront for a reduced interest rate.

- If you have an adjustable-rate lending, your regular monthly settlement may transform as soon as every 6 months based upon any type of rise or reduce in the Guaranteed Overnight Financing Price index.

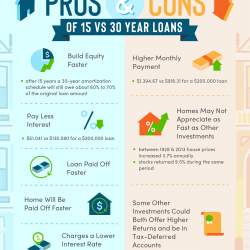

- The 30-year term is commonly the longest home loan term you can get.

- However if you are more youthful, you'll likely receive smaller sized payouts on your HECM.

- Just keep in mind that when ARM prices increase, you have to await higher month-to-month payments.

So their base home mortgage rate is changed greater or lower for each and every financing they use. Higher mortgage prices for higher threat; reduced prices for less perceived danger. Private mortgage insuranceon a conventional car loan, FHA home loan insurance coverage can not be terminated.

As well as yours may be higher or less than typical depending Have a peek here upon your individual financial resources. All Lending Price quotes utilize the same format so you can easily compare them alongside. If you have greater than 20% equity in your home– and a credit history over 620– you can potentially use a traditional cash-out re-finance instead. You could walk away with a sign in hand and also eliminate home loan insurance coverage repayments. Variable-rate mortgages pretty much always have lower preliminary mortgage rates than fixed-rate loans. The much less time you're paying passion, the much less rate of interest you'll pay.

Mortgage Insurance Coverage Costs Mip

A preapproval allows sellers understand you're a major customer as well as provides you extra working out power when it comes time Learn more here to make an offer. Direct Down payment Send funds straight to your account to guarantee seamless down payments while you're deployed or traveling. The Ultimate Certificate Technique Laddering your certificates is an exceptional way to ensure you gain the best rates possible. Before signing up with Expert, she wrote about monetary as well as vehicle subjects as a freelancer for brands like LendingTree as well as Credit Report Fate. World world An icon of the world globe, indicating different worldwide alternatives." They remained to decline via the housing situation of 2008 up until November 2012.

What Are Discount Points On Fha Mortgage Rates?

This took place after the collapse of the real estate bubble in 2006 as well as 2007, which was triggered by the subprime credit history trouble. Given that loan providers prolonged mortgages to borrowers with shaky debt and big financial debts, they had higher risk of back-pedaling loans. If you aren't able to afford the price of month-to-month home mortgage insurance in addition to your existing bills, after that conserving for a higher deposit might be a better alternative. FHA mortgage allow the seller to compensate to 6% of the closing costs, consisting of any type of costs of the appraisal, residential property title search or a credit history report.

Federal Reality in Loaning Act needs loan providers to divulge the APR, however the costs can differ. When comparing APRs in between lending institutions, ask which charges are not consisted of for far better comparison. A few of the Services involve recommendations from 3rd parties as well as third party web content. You agree that Interest.com is not accountable for any suggestions offered by third parties. To make use of a few of the Providers, you may need to give information such as bank card numbers, checking account numbers, as well as other delicate financial details, to third parties.

Due to the fact that MIP is spent for majority of the home loan term, it makes your regular monthly settlements much more expensive with time. To remove this additional price, several FHA debtors at some point re-finance into a standard home mortgage. Refinancing is essentially taking a new financing to settle your existing home loan. It's a technique that allows you to minimize your present home mortgage price, reduce your term, or both. Novice homebuyers use FHA fundings as a way to secure an economical home loan.

They insure the FHA lendings that we can aid you in getting. Quicken Loans has actually been providing our clients with award-winning solution since 1985. We service 99% of our fundings, which indicates you'll get the very same care as well as focus throughout the entire life of your financing. The FHA's restriction for lower-cost areas is evaluated $420,680 in 2022. You could still receive an FHA financing if you've had a personal bankruptcy or various other financial problems in the past. As a result of various federal, state and regional needs, particular items might not be available in all areas.

Lenders fee greater house mortgage rates to customers they regard riskier. So having a high credit rating (740+) will get you the most effective interest rates. Lenders also check out how much you are obtaining compared to the house's value; this is called loan-to-value, or LTV. So if your future house has a value of $200,000, you'll obtain the most effective prices if the funding is for $160,000 or much less.

Ingen kommentarer endnu