do you recognize the 8 sorts of home mortgages

You might also need to take residential or commercial property guidelines as well as income restrictions right into account when you apply for an adhering car loan. A Home Loan Specialist can aid identify if you certify based on your special financial scenario. In the present home mortgage market, you 'd commonly get a tracker home mortgage with an introductory offer period. After this, you are gone on to your loan provider's basic variable price. Now that you have a concept of the best kind of loan for your house purchase, it's time to find the appropriate mortgage loan provider to make it occur.

- As an example, you can get up to $2.5 million in a jumbo financing if you pick Rocket Mortgage.

- These can likewise be particularly helpful if you plan on paying additional towards your loan early.

- After the initial five years, we'll state the price bumps up by simply a quarter percent every year.

- You have to fulfill service requirements in the Army or National Guard to get a VA lending.

- Types of debt credit cards, pawnbrokers, home credit, shop as well as catalogue cards and also overdrafts.

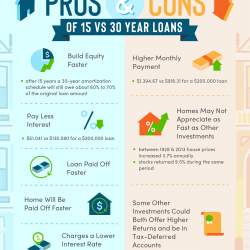

You'll end up paying almost $61,000 in passion over the life of the loan. The 15-year fixed-rate home loan is the best type of home loan as well as the only one we at Ramsey ever before recommend to home purchasers since it has the lowest complete cost compared to any kind of various other kind of home mortgage. If you're acquiring a property to lease, you'll require a buy-to-let mortgage. A buy-to-let investment can be a large dedication, so it is very important to take into consideration costs, duties as well as the risks of ending up being a proprietor.

An applicant can approve approximately 100% of the down-payment in the form of a gift from a family member, friend, company, philanthropic group, or federal government homebuyer program. They help veterans & active duty military participants manage purchasing a residence without needing a down-payment by guaranteeing 20% of the financing's worth up to the adjusting finance limit. If the rate it is tracking rises, so will certainly your home loan settlements. If the rate it is tracking falls, so will your mortgage repayments. If you get on your home mortgage loan provider's SVR, you'll remain on this rate as long as your mortgage lasts or until you obtain an additional home mortgage offer.

Jumbo Loans

With a fixed rate home loan, you will pay a set interest rate for a specific number of years. Trustworthy makes obtaining a Streamlined Pre-Approval Letter for a home loan easy contrasted to other lending institutions. You can create a Structured Pre-approval Letter immediately and also you can finish the entire process online in simply a few mins.

Comprehending Mortgage Rates Of Interest

Technically, there isn't a mortgage called an 'SVR home mortgage'– it's just what you can call a mortgage out of a bargain https://consent.yahoo.com/v2/collectConsent?sessionId=2_cc-session_65e846f9-ac59-4d4d-973f-3c162ae30baf duration. After their bargain expires, a great deal of people find themselves on an SVR home loan by default, which might not be the very best price for them. Most loan providers will certainly have a Standard Variable Rate, which is the rate billed when any type of taken care of, marked down or various other sort of home mortgage bargain involves an end. There are typically no Early Settlement Charges if you want to switch over far from your lender's SVR. After the fixed duration finishes, you will typically move onto your loan provider's Requirement Variable Price, which is most likely to be much more pricey.

However obtaining the wrong mortgage could cost you tens of thousands of dollars as well as decades of financial obligation– as well as a lifetime of cash fights! If they are presently available, a 95% financing to value home loan allows first-time purchasers to contribute a 5% deposit. If qualified, this implies you can possibly borrow up to 95% of your home's value or the acquisition rate. Jumbo refers to a mortgage that's also big for the Federal Government to buy or assure.

A home mortgage broker is an intermediary who brings mortgage consumers and mortgage lending institutions with each other however does not utilize its very own funds to come from home mortgages. A versatile payment ARM was a sort of adjustable-rate mortgage that enabled customers to select from four various repayment options monthly. The cost of a residence is often far more than the amount of money most families save. Consequently, home loans permit individuals as well as family members to buy a residence by putting down just a fairly tiny down payment, such as 20% of the purchase price, and also acquiring a finance for the balance. The finance is after that secured by the worth of the building in situation the debtor defaults. Individuals and also companies make use of home loans to https://www.topratedlocal.com/wesley-financial-group-reviews acquire real estate without paying the whole purchase cost upfront. The borrower pays off the loan plus rate of interest over a defined number of years up until they have the building cost-free and clear. Mortgages are additionally referred to as liens against residential or commercial property or claims on building. If the debtor stops paying the mortgage, the lending institution can foreclose on the building. Than on many various other lendings, providing relatively reduced month-to-month repayments initially. The quantity you can obtain is partially based upon the amount of rental fee you expect to get yet lending institutions will certainly take your income and individual conditions into account too. They need to also apply a' cardiovascular test' to ensure that they can see whether you 'd have the ability to afford higher mortgage prices in future. First time buyers will locate it even more of an obstacle to get a Buy to allow home loan. You initially accept an introductory period of set interest when you authorize onto an ARM. If you join for a 5/1 ARM funding, for example, you'll have a set rate of interest for the first 5

Ingen kommentarer endnu