selling mortgages

Home mortgage lending institutions will certainly require to approve potential consumers with an application as well as underwriting procedure. Mortgage are only supplied to those who have adequate possessions and also income relative to their debts to almost carry the value of a house in time. A person's credit history is also evaluated when deciding to extend a home mortgage The rates of interest on the home loan likewise differs, with riskier borrowers getting higher rates of interest. Mortgage-backed safety and securities, called MBS, are bonds safeguarded by home and also various other real estate finances.

- As a whole, you will need to meet both of these limits for your home loan to satisfy the Central Bank's requirements.

- Bankrate.com does not consist of all business or all readily available products.

- While on forbearance, customers can make full or partial payments if they can do so.

- A house mortgage is a funding given by a bank, mortgage company or various other banks for the acquisition of a key or investment home.

- These laws were brought in by the Central Bank in 2015 and also have actually been changed a number of times.

That can mean a difference of greater than $70 a month on the settlements for a $250,000 home loan, or as much as $36,000 over the https://truxgo.net/blogs/313813/891284/what-is-a-reverse-home-mortgage life of the car loan. For these factors, public laws to control the U.S. home loan market or urge home ownership will be flawed unless they consider the considerable market setting of these nonbank loan providers. The listing of financial institutions that don't offer their mortgages varies extensively by geographical location. The lack of law meant that banks might get their cash immediately by offering mortgages instantly after making the lendings, but investors in MBS were essentially not secured at all. If the consumers of mortgage defaulted, there was no sure way to compensate MBS investors.

Fha Funding Restrictions Raise For 2022

Hearing that your home mortgage has actually been marketed can be stressful, yet do not worry way too much. Financiers trying to find other attributes, such as those based on danger or timing of cash flow, can locate other MBS bonds to fulfill their certain how do you get rid of timeshares demands. Our experts have actually been helping you grasp your cash for over 4 decades. We constantly make every effort to provide customers with the expert guidance as well as devices required to do well throughout life's monetary trip.

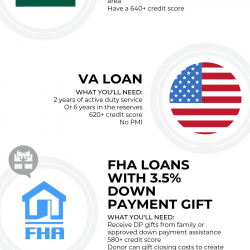

Home mortgage early repayments are typically made due to the fact that a home is offered or due to the fact that the property owner is re-financing to a new home loan, presumably with a reduced rate or much shorter term. Prepayment is identified as a risk for the MBS financier despite the fact that they receive the money, because it often tends to take place when floating rates drop and also the fixed income of the bond would certainly be more valuable. foreclosure timeshare In other words, the proceeds obtained would certainly need to be reinvested at a lower interest rate. The additional home mortgage market makes it possible for capitalists to get mortgage-backed safety and securities, entitling them to principal and rate of interest from home mortgage settlements. These megabyteses are commonly offered by major home mortgage financiers like Fannie Mae, Freddie Mac, the FHA and also VA . These agencies provide financier security, by ensuring future repayments in case of default.

What Should I Do If My Financial Institution Offered My Home Loan?

The establishment that purchased your car loan needs to after that alert you within one month of the main date of the adjustment. This notice will include the name of the business that now has your home loan, its address as well as its phone number. Keep in mind, loan providers and banks may be making big earnings, but they don't have an infinite amount of cash lying around. They often need to ditch existing financings– such as your home loan– to be able to have adequate cash money to provide to various other clients. You should not be amazed or startled, also if you were aiming to pay off your mortgage early.

Why Do Banks Market Their Mortgages

You should exercise your earnings and expense as well as evaluate how they are most likely to alter gradually, depending upon your employment circumstance, your family circumstance and also your stage in life. In general, you will have to meet both of these limits for your home loan to satisfy the Central Bank's demands. The lending institution has to also assess each lending application on a case-by-case basis– see 'Evaluation by the loan provider' listed below.

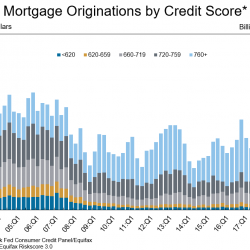

It might end up that they're providing the most effective terms for somebody with your credit report and monetary profile on the type of mortgage you're looking for. Assessing mortgage application data and a range of various other datasets, we recorded the essential visibility of shadow financial institutions over the past years. Shadow financial institutions had a significant market presence prior to the housing accident of a decade earlier, but after that retreated amidst extensive failures. Strikingly, considering that 2009, shadow banks have actually recovered their market share and currently make up the mass of brand-new home loan financing. Federal banking laws allow financial institutions to sell home loans or move the servicing legal rights to other establishments. Refinancing is a procedure that allows you to renegotiate the terms of your mortgage.

Upon completion, the purchaser needs to offer all the staying cash required to complete the acquisition of the residential property. A home mortgage lending institution will certainly examine your credit rating as component of your mortgage application. An excellent credit rating could have a positive effect on the likelihood of an application being approved.

Ingen kommentarer endnu