what is a mortgage and just how do i obtain one

A fixed-rate mortgage has a rate of interest that continues to be the very same throughout the life of your lending. This is a great choice for those that favor uniformity and simplicity while budgeting, as the month-to-month repayment will certainly never ever change. These sorts of loans are typically constructed in 15-year fixed-rate financings or 30-year fixed-rate lendings. That's why lots of homebuyers select taken care of rates to supply satisfaction that their interest rate and also monthly settlements will not change. Amortgage is a sort of financing where realty is used as collateral. A home loan is generally utilized to fund your home or a financial investment building so you don't need to pay the entire amount upfront.

Missed repayments for any kind of borrowing can additionally adversely influence your credit rating, which can have a destructive influence on your ability to access lending products in the future. There are a number of types of finances, which may be either fixed-rate or adjustable. You'll additionally have the ability to choose the finance term, or how much time you'll need to pay off the home mortgage.

Mortgages are likewise referred to as liens against home or cases on residential or commercial property. If the customer quits paying the home loan, the loan provider can foreclose on the home. Exclusive home loan insurance is a form of insurance coverage gotten by the loan provider however commonly spent for by you, the debtor, when your loan-to-value ratio is above 80 percent. If you skip as well as the loan provider needs to confiscate, PMI covers several of the shortage in between what they can market your residential property for and what you still owe on the home mortgage. A home loan servicer is the company that handles your mortgage statements and also all daily tasks connected to handling your loan after it closes. As an example, the servicer accumulates your repayments and, if you have an escrow account, guarantees that your taxes as well as insurance policy are paid on time.

- The component of the repayment that goes to passion does not reduce your equilibrium or construct your equity.

- Figure out what home loans are and also the fundamentals of exactly how they work in our easy-to-understand guide.

- If your present employment agreement results from end after a certain period of time, or after a particular piece of work is complete, you are likely on a set term agreement.

- A good credit rating might have a favorable impact on the possibility of an application being approved.

- See to it you recognize the payment choices after the forbearance duration finishes.

- A 2nd borrower could aid you get a mortgage by enhancing your complete income or boosting your consolidated credit report.

This program is for customers who have actually remained current on mortgage settlements previously. Source cost– Along http://myleslalt994.raidersfanteamshop.com/acquire-to-offer-home-mortgage with the application or handling cost, the lending institution may likewise charge an origination Additional hints cost. This covers the additional work the lender needs to do when preparing your home loan. If the fee is a portion of the car loan, after that it is generally considered a "discount factor" in camouflage. This transforms the tax obligation implications and wyndham timeshare rescind letter your prices, so make certain to ask the lending institution about this fee.

Mortgage 101: Basics Every Home Customer Ought To Understand

The ordinary home cost across the UK has actually remained relatively high as well as is currently around ₤ 228,000. HSBC is just one of the largest lenders in the UK, giving a range of award-winning, wonderful value mortgages for individuals looking for a residence or a buy to let residential property. If you're taking into consideration buying a house in the UK, find out about home loans in the UK and what you'll need to obtain one. You'll pay off your home mortgage quicker by making an extra month's repayment every year.

A Simple Meaning Of A Home Loan

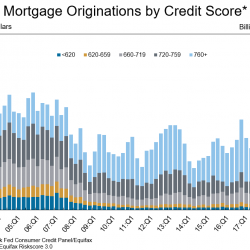

Home mortgage are just provided to those that have enough properties and revenue about their financial obligations to practically carry the value of a home in time. A person's credit history is additionally evaluated when making the decision to prolong a mortgage. The rate of interest on the mortgage additionally varies, with riskier borrowers receiving higher interest rates.

Changing Home Mortgage

The funds you obtain with a mortgage can only be made use of to get, re-finance, or boost a residence. Act recording fees– These charges, generally around $50, pay the region staff to videotape the action and home loan and also change the invoicing information for real estate tax. Appraisal charge– Since the lender intends to make sure the residential or commercial property is worth what you are spending for it, it calls for an evaluation. An evaluation compares the worth of the building to comparable residential or commercial properties in the very same community.

This schedule will reveal you how your finance equilibrium goes down over time, along with just how much principal you're paying versus rate of interest. Though home mortgage is generally made use of as a catchall term for a mortgage, it has a particular significance. The home mortgage offers the lending institution the right to take possession of your house as well as market it if you don't make payments at the terms you accepted on the note. That means if you damage the pledge to repay your home mortgage, the financial institution deserves to confiscate on your home.

If this is not your very first home mortgage, you could require to pay early repayment fees or departure costs to get out of your old plan. You will certainly additionally have evaluation fees if offering your old property. If you are getting a residential or commercial property with a companion or enjoyed one, have a chat with them to get their point of view and also recommendations. There are 2 types of prices offered when it pertains to a settlement mortgage. Home mortgage insurance coverage shields your lending institution if you're incapable to satisfy contractual obligations.

Ingen kommentarer endnu