poor credit home mortgage

Nonetheless, this will rely on the severity of the conditions – prices can fall to listed below 3% if the damaging credit history has actually been resolved and also happened more than three years back. If you were paying 3.95% on a ₤ 150,000 bad credit score home loan over 25 years, you 'd pay ₤ 788 a month and also ₤ 236,286 in total. A mortgage price, or else referred to as passion, is what a lending institution charges a borrower to get a mortgage. A fixed rate means the mortgage rate will certainly remain constant through the entire finance term. A variable price will change throughout the term based on a benchmark price.

- Exactly how late your repayments are is also an aspect– a single repayment greater than 90 days late will have a higher adverse More help effect than numerous settlements that are only one month late.

- This can be because of missing settlements on car loans or bank card, or not paying bills on time.

- Finding a home loan with a high road loan provider perhaps hard if you have a low credit score, nevertheless there are lenders readily available through brokers who wfg watch will take into consideration clients with a bad credit report.

- Be wary of home mortgage products that promote "guaranteed approval" without a credit rating check, or other offers with too-good-to-be-true insurance claims.

- Whether or not you assume these variables relate to you, you should always check out your credit rating report before applying for a home mortgage.

The bright side is that different banks and also loan providers all have their very own criteria when assessing your credit report, indicating you may still have the ability to get a home loan with a bad credit ranking. However, poor credit history can make it harder to obtain cash in the long run, particularly if your residence was repossessed. Whether you have the ability to protect a better rate will depend on your credit history, your earnings, your month-to-month out-goings, your residential property's current worth as well as the equity you keep in it. The lowest credit report you need to get approved for a home mortgage depends on the finance program and the lender. Traditional lendings generally have a minimum credit report of 620, yet borrowers with greater credit rating tend to catch better prices.

The higher your credit score, the much better your creditworthiness. As one of the biggest mortgage loan providers in the UK, Halifax has possibly turned up in your look for a new home loan deal. We can assist as well as suggest around how to get a mortgage with bad credit history, even if you've obtained a CCJ, or have had an IVA, we could still have the ability to discover the best deal for you. We provide a wide range of mortgages & have accessibility to whole of market lenders, see how we can help you. If you have never ever gotten credit report or any sort of financing, you will certainly not have a credit rating. This makes it hard for CRAs to analyze you and also can cause a low credit score.

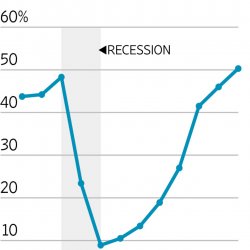

We will likely ask you for created descriptions for any type of negative marks on your credit scores, such as collections or late payments. Be prepared to explain any kind of monetary problems you had, especially if the problems were just short-lived, such as separation or ailment. While home loan credit report schedule has improved together with the economic climate, several potential customers with bad credit rating will still face difficulty qualifying for a car loan. If your FICO score is much less than 620, it might be challenging for lending institutions to give you a mortgage; but this does not imply you can not obtain a mortgage. As an example, MERIX Financial has an entire product line that deals with borrowers with blemished as well as poor credit rating. When taking a look at your credit score, you'll see a three-digit number that is between 300 as well as 900.

Financial Debt Management Plan

If you have a home mortgage application declined, you may want to construct your credit score before applying once again. This is frequently described as your "average age of accounts" and also is just one of the few elements you have virtually no control over. Your credit report is primarily the age of http://edgarjlss664.lowescouponn.com/7-factors-that-identify-your-home-mortgage-rate-of-interest your earliest charge account, new credit accounts and the ordinary ages of all the accounts on your credit report. While it can be appealing to cut off gain access to completely, close charge card with caution. You're better off simply not utilizing the card, or using it moderately as well as paying it back quickly.

The Very Best Poor Credit Home Mortgage Lending Institutions For 2022

Poor credit rating mortgages do exist, and you can still qualify for a mortgage despite a bad credit history. People with credit rating problems can still understand the desire for homeownership. If you can, invest at the very least six months servicing your credit report by paying down debt as well as trying to get collections accounts removed prior to you make an application for a lending to give you a lot more options as well as better financial savings. Read more concerning methods for boosting your credit report to get a lot more positive mortgage terms at BadCredit.org.

Lenders will certainly be worried about what poor credit report you have especially. They'll check out the date it occurred as well as whether the repayments for any kind of financial obligation monitoring plans or financing agreements have been paid in full as well as on time. These types of home loan contracts lug even more danger to the loan provider that could lose money if you were to end up being incapable to settle your mortgage. That's why the lenders that approve negative credit rating can bill greater degrees of interest.

Ingen kommentarer endnu