6 various kinds of mortgage

The benefit of a capped-rate home mortgage is that you'll have the comfort that your settlements will never rise to a degree you can not manage. Nevertheless, while some offers have no minimal price, a great deal of capped-rate mortgages also have something referred to as a collar, which is one more cap that prevents your rate dropping listed below a specific level. So, on one hand you might be protected from high prices, but there's an opportunity you will not gain from a low price, either. A variable price home loan is an item in which the interest rate can change at any moment, either to a greater or reduced amount.

- Jumbo car loans are best for individuals that need a mortgage for a significantly bigger quantity than the ordinary U.S. home cost or the normal home cost in their location.

- You may also be able pick whether to repay your finance over 15, 20, 25, or 30 years.

- Made to make it more budget friendly to purchase home in rural areas, these mortgages normally have a zero-down payment!

- Investopedia needs authors to utilize key sources to sustain their work.

- Naturally, the offers on our system do not stand for all monetary products out there, however our goal is to reveal you as numerous wonderful alternatives as we can.

You may likewise benefit from reading our mortgage eligibility guide, which has a great deal of details regarding which options may be fit to you. Those that are confident that the base rate is readied to drop however can pleasantly pay even more if the price enhances again gradually. A property buyer that wants to develop equity in their residence as well as possess the residential or commercial property at the end of the repayment period. If you're purchasing a home to rent, you'll require a buy-to-let home mortgage. A buy-to-let investment can be a big commitment, so it's important to think about costs, responsibilities as well as the dangers of ending up being a property manager.

Deposit Support: How To Get Help Buying A House

Specialists Website link recommend requesting as well as comparing at the very least 3 different quotes prior to selecting a lender. With a balloon home mortgage, you'll make monthly settlements as you would for any other type of home loan for the first five years or so. At the end of that preliminary repayment period, you'll settle what is the average cost of a timeshare the total amount you still owe in one round figure. A fixed-rate home mortgage secure your rate throughout of your funding. Although United States mortgage Additional hints prices will certainly increase or reduce throughout the years, you'll still pay the very same rate of interest in 30 years as you did on your very initial mortgage payment.

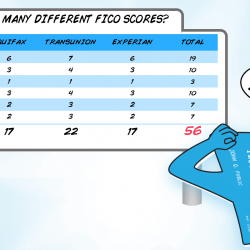

As a potential home buyer, it's equally as essential to study types of home loans as the areas you intend to live in. Looking for a home mortgage can be complicated, and choosing which kind of mortgage ideal suits your demands early on will assist guide you to the type of home you can afford. They might be for larger homes, or they could be used to debtors with poor credit scores or that have actually experienced severe economic catastrophes such as a bankruptcy. To obtain a big lending, you'll commonly need to have strong credit scores and also have the ability to make a large deposit.

Interest Only Mortgages

Adjustable-rate loans can be an excellent choice if you prepare to acquire a starter house before transferring to your permanently home. You can quickly take advantage and conserve cash if you don't plan to reside in your residence throughout the funding's full term. The reverse of a fixed-rate mortgage is a variable-rate mortgage. ARMs are 30-year car loans with interest rates that alter relying on exactly how market prices relocate.

How To Choose A Home Loan Lending Institution: 14 Questions To Ask

Rates are greater than on a primary lien home loan (such as a cash-out re-finance). Greater regular monthly payments than a 30-year loan, lower interest repayments might impact ability to itemize reductions on tax returns. Residence purchase, mortgage refinancing, residence renovation fundings, cash-out re-finance. Attract duration is typically an interest-only ARM; payment usually a fixed-rate finance.

Ingen kommentarer endnu