first hawaiian financial institution household real estate division

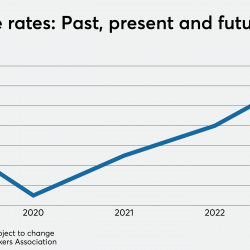

When your financing's rate of interest climbs, your monthly home loan repayment generally raises; if the price drops, your monthly home loan payment usually decreases. When you acquire adverse factors the financial institution is betting you are likely to pay the greater interest rate for a prolonged period of time. If you pay the higher rate of interest for the duration of the finance after that the bank obtains the winning end of the offer. Lots of people still take the deal though because we tend to mark down the future & over-value a round figure in the present. It is the same factor bank card are so rewarding for financial institutions.

- A fund with expenditures of 0.45% is said to be five basis points extra costly than one with a 0.40% proportion.

- Specifically vital to large-volume mortgage lenders, basis factors– also simply a couple of– can mean the difference between profit and also loss.

- When you pay price cut factors, you're essentially pre-paying some of the rate of interest on a funding.

- The lending officer then recommends you that the lender costs 50 basis indicate secure your rate for that duration.

- Setting and reaching your individual economic objectives is the most effective way to ensure that you can live the sort of life you desire, both currently and also in retired life.

Call us initially or call us last, however you can not manage to not call Basis Point Home mortgage whereService, Integrity, andExperienceare not just words, but a way of life. I angle discover where these policies are provided as well as wish to be aure that this isn't just the financial institution favoring us to have a higher rate for higher rate of interest for their longterm advantage. I actually need to think of what benefit me as well as my family members.

Purchasing A House

Bps are additionally used to explain the transforming rate of interest of a house mortgage. This is because home loans rates will certainly typically change much less than 1%. You can fry your brain considering home loan payments enhancing 0.35%, whereas using 35 bps is easier to calculate. The major use for basis factor computations is in finance as well as business economics when individuals want to measure little adjustments gradually.

Various Other Banking Terms

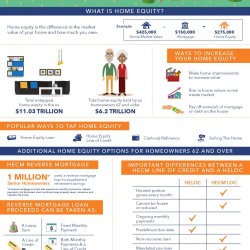

We additionally reference initial Cruises Timeshares research from other trustworthy publishers where appropriate. You can discover more concerning the criteria we adhere to in generating exact, impartial web content in oureditorial plan. Though most people hope to see their house rise in value, couple of people purchase their house purely as a financial investment. From an investment viewpoint, if your residence triples in value, you might be not likely to sell it for the easy factor that you after that would need to locate somewhere else to Wesley Financial Group Glassdoor live.

Inevitably, it's your decision in terms of what you really feel is worth buying down to if at all as well as you need to do the math to see the break-even durations for certain buy downs. I just recently acquired a home and also got a lending institution credit history of approx. Charge of $6400, leaving me with a modified orig cost of -approx $3600. I am allowed to declare repayment for my action for "expenses really incurred" to include orig. I'm informed this charge is not mosting likely to be allowed considering that I obtained a credit and also did not sustain the expense.

It is necessary to understand exactly how this conversion functions, since many financial investments are measured in terms of bps as opposed to percent. A representative's charge for working out a realty or mortgage loan purchase, commonly revealed as a percentage of the asking price. Relating to set you back basis, this is the amount assigned to a possession from which a taxpayer determines resources gain or loss.

Quantities paid to the lender along with a mortgage to decrease the rate of interest. One discount rate point equates to one percent point of the lending amount. The fee charged by a broker or representative for negotiating a real estate of financing transaction. A broker commission is usually a percentage of the cost of the home or funding. The expenditure of either getting a mortgage loan or moving property from a vendor to a purchaser, consisting of lawyer's charges, study costs, title searches as well as insurance coverage, and recording costs.

The abbreviation for plural use "basis factors" is bps (noticable "bips"), so in the example above you could state your quote rose by 25 bps. One basis factor is one one-hundredth of a percent, or 0.01 percent. Whether you are shopping for an automobile or have a last-minute cost, we can match you to funding offers that fulfill your requirements as well as budget plan. Basis factors, you move the decimal point two locations to the right.

To quickly calculate the equal portion of increase or reduction, relocate the decimal point 2 spaces to the left. For example, if the rate of a commercial mortgage has actually risen 25 basis points, it has actually climbed 0.25 percentage points. Home loan factors, also known as price cut points, are a form of pre paid interest You can select to pay a percentage of the rate of interest in advance to lower your rates of interest as well as month-to-month payment. A home mortgage factor amounts to 1 percent of your complete loan amount. Learn more regarding what home loan points are and determine whether "purchasing factors" is an excellent option for you.

Ingen kommentarer endnu