16 types of mortgages

The majority of loan providers do not provide for a succeeding home mortgage backed by the exact same residential or commercial property. A 5/1 variable-rate mortgage is an ARM that maintains a set rate of interest for the initial five years, then adjusts annually afterwards. As their name suggests, reverse home mortgages are a very different financial product. They are created for house owners 62 or older who want to convert part of the equity in their homes right into money. ARMs typically have limits, or caps, on how much the rates of interest can rise each time it adjusts and also in complete over the life of the lending. Stay in the recognize with our most recent home stories, mortgage rates as well as refinance pointers.

- Property civil liberties offer a title of ownership to the land, enhancements, as well as natural resources such as minerals, plants, pets, water, etc.

- The transfer undergoes this condition that the mortgagee will re-transfer the home to the mortgagor upon paying of the mortgage cash as agreed.

- If they are presently readily available, a 95% loan to worth home mortgage enables newbie buyers to contribute a 5% down payment.

- Over a collection period of time, you obtain a discount rate on the lender's SVR.

- Completion of the set period– you must try to find a new home mortgage offer two to three months before it ends.

With a resources settlement mortgage, the regular monthly payments consist of a component which pays off the borrowed funding, along with a settlement for the month-to-month passion of the loan. The variety of home loan offers readily available to you will certainly rely on just how large a down payment you have to put down, or the level of equity you have in your building. Lenders typically provide their best rates to those with larger deposits, as they are considered reduced threat. If you want to repay your home mortgage and button to a brand-new deal before your taken care of price comes to an end, there will usually be Early Payment Fees (ERC's) to pay.

Refinance Your Existing Finance

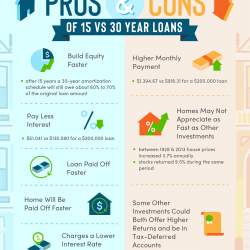

A much shorter home loan generally means greater payments, a lower interest rate, and less overall passion paid. A longer home mortgage typically has a lower repayment and a greater rates of interest. You would certainly select the longer term when you require the lower settlement or desire even more versatility to select when to pay off the funding. An adjustable-rate mortgage is a mortgage where your interest rate frequently alters over the life of the car loan. The price is generally an index, such as the Federal Funds Rate, plus an extra margin included by your loan provider. You might believe that getting a home loan is hard sufficient, yet wait until you learn that there are all various types of home loans.

Contrast Countered Mortgages

If you can not get approved for a conventional financing as a result of a lower credit rating or limited financial savings for a down payment, FHA-backed and also USDA-backed loans are a terrific option. For army service members, experts as Go to this site well as eligible partners, VA-backed finances can be a great option– typically much better than a standard financing. USDA finances– USDA fundings aid moderate- to low-income debtors get residences in backwoods. You have to purchase a residence in a USDA-eligible area and also satisfy specific income limitations to certify.

This sets apart discounted variable price mortgages from tracker mortgages, which constantly track the modifications made to the base rate– as opposed to the loan provider's SVR. A reverse home mortgage gives house owners accessibility to their home's equity in a car loan that can be taken out in a lump sum, with established month-to-month repayments, or follow this link as a rotating credit line. Home owners do not have to make payments, yet the loan provider will have a lien on the residence for the quantity owed upon Click here! the fatality of the debtor. When you're in the process of buying a home, there are various kinds of home loan to choose from, which can feel overwhelming. However if you do your due diligence, especially around nailing down your month-to-month budget, down payment quantity, as well as credit report, you'll have a better suggestion of which kind of finance will work best for you. House purchasers can select from fundings paid over 10, 15, 20, 30 and even 50 years.

Ingen kommentarer endnu