the greatest guide to how many home mortgages has the fha made

Own a paid-off (or at least considerably paid-down) home. Have this house as your main residence. Owe no federal debts. Have the cash circulation to continue paying property taxes, HOA costs, insurance, upkeep and other house expenditures. And it's not simply you that needs to qualifyyour home also needs to satisfy particular requirements.

The HECM program likewise allows reverse home mortgages on condominiums authorized by the Department of Real Estate and Urban Development. Prior to you go and sign the documents on a reverse home mortgage, inspect out these 4 major downsides: You may be believing about taking out a reverse home loan due to the fact that you feel positive loaning versus your house.

Let's break it down like this: Imagine having $100 in the bank, however when you go to withdraw that $100 in cash, the bank just offers you $60and they charge you interest on that $60 from the $40 they keep. If you would not take that "offer" from the bank, why on earth would you wish to do it with your home you've invested years paying a mortgage on? But that's precisely what a reverse home mortgage does.

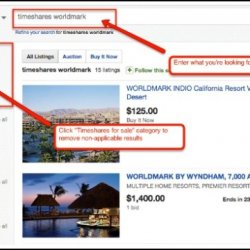

The Best Guide best timeshare companies To What Are Current Interest Rates For Mortgages

Why? Because there are fees to pay, which leads us to our next point. Reverse home mortgages are loaded with extra expenses. And many customers decide to pay these costs with the loan they will getinstead of paying them out of pocket. The thing is, this expenses you more in the long run! Lenders can charge up to 2% of a house's worth in an paid up front.

5% home mortgage insurance coverage premium. So on a $200,000 house, that's a $1,000 annual expense after you've paid $4,000 upfront naturally!$14 on a reverse home loan resemble those for a routine home loan and include things like house appraisals, credit checks and processing charges. So before you know it, you've drawn out thousands from your reverse home mortgage before you even see the very first cent! And since a reverse home mortgage is just letting you take advantage of a portion the value of your home anyway, what takes place once you reach that limitation? The cash stops.

So the amount of money you owe increases every year, on a monthly basis and every day until the loan pueblo bonito timeshare is settled. The marketers promoting reverse home loans like to spin the old line: "You will never owe more than your home is worth!" But that's not precisely true due to the fact that of those high rates of interest.

See This Report about What Is The Truth About Reverse Mortgages

Let's say you live till you're 87. When you pass away, your estate owes $338,635 on your $200,000 home. So instead of having a paid-for home to pass on to your loved ones after you're gone, they'll be stuck with a $238,635 expense. Chances are they'll need to sell the house in order to settle the loan's balance with the bank if they can't afford to pay it.

If you're spending more than 25% of your earnings on taxes, HOA costs, and home costs, that suggests you're home bad. Reach out to among our Endorsed Local Suppliers and they'll assist you navigate your choices. If a reverse mortgage lender informs you, "You will not lose your house," they're not being straight with you.

Think of the factors you were thinking about getting a reverse mortgage in the very first place: Your spending plan is too tight, you can't manage your day-to-day expenses, and you don't have anywhere else to turn for some extra cash. Suddenly, you have actually drawn that last reverse home mortgage payment, and then the next tax expense comes around.

What Is The Truth About Reverse Mortgages Fundamentals Explained

If you don't pay your taxes or your other costs, the length of time will it be before someone comes knocking with a property seizure notice to remove the most important thing you own? Not really long at all. Which's possibly the single most significant factor you ought to avoid these predatory financial products.

In a word, a reverse home loan is a loan. A property owner who is 62 or older and has considerable home equity can obtain against the worth of their house and get funds as a swelling amount, repaired monthly payment or credit line. Unlike a forward mortgagethe type utilized to buy a homea reverse home mortgage doesn't need the property owner to make any loan payments.

Federal regulations need lending institutions to structure the transaction so the loan quantity doesn't surpass the home's value and the customer or customer's estate will not be delegated paying the difference if the loan balance does end up being larger than the house's worth. One way this could happen is through a drop in the house's market price; another is if the debtor lives a long time (why reverse mortgages are a bad idea).

Fascination About How Does Chapter 13 Work With Mortgages

On the other hand, these loans can be expensive and complicated, as well as based on scams. This article will teach you how reverse home mortgages work, and how to safeguard yourself from the mistakes, so you can make an educated choice about whether such a loan might be ideal for you or your parents.

14 trillion in house equity in the first quarter of 2019. The number marks an all-time high considering that measurement started in 2000, underscoring how large a source of wealth home equity is for retirement-age adults. House equity is only functional wealth if you sell and downsize or obtain against that equity.

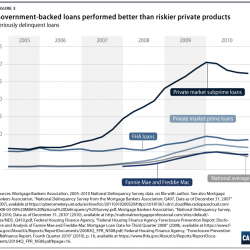

A reverse mortgage is a kind of loan for seniors ages 62 and older. Reverse home loan permit property owners to transform their home equity into money earnings with no month-to-month mortgage payments. Most reverse mortgages are federally guaranteed, but be careful a spate of reverse mortgage frauds that target elders. Reverse mortgages can be a great financial decision for some, however a poor decision for others.

The smart Trick of How Many Home Mortgages In The Us That Nobody is Talking About

With a reverse mortgage, rather of the property owner paying to the lender, the lender makes payments to the property owner. what is a gift letter for mortgages. The property owner gets to choose how to get these payments (we'll explain the options in the next section) and just pays interest on the proceeds received. The interest is rolled into the loan balance so the house owner does not pay anything in advance.

Over the loan's life, the property owner's debt increases and home equity decreases. Similar to a forward home loan, the house is the security for a reverse home mortgage. When the homeowner moves or passes away, the profits from the home's sale go to the lender to repay the reverse mortgage's principal, interest, home mortgage insurance, and fees.

In some cases, the beneficiaries may pick to pay off the home loan so they can keep the home. Reverse home mortgage profits are not taxable. While they might seem like income to the house owner, the Internal Revenue Service thinks about the cash to be a loan advance. There are three kinds of a reverse home loan.

What To Know About Mortgages In Canada Things To Know Before You Buy

The HECM represents practically all of the reverse home loans lenders offer on house worths listed below $765,600 and is the type you're most likely to get, so that's the type this post will go over. If your home is worth more, nevertheless, you can check out a jumbo reverse mortgage, also called a proprietary reverse home loan.

Ingen kommentarer endnu